Roth ira phase out calculator

One way to calculate your limit is to take your income subtract the maximum income you can earn. This calculator assumes that you make your contribution at the beginning of each year.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021.

. Roth IRA Phase-Out Ranges. For example you cant contribute anything to a Roth. Roth IRA contributions are limited for higher incomes.

Roth Ira Income Limits 2019 Phase Out Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable. This calculator assumes that you make your contribution at the beginning of each year. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021.

So thinking youre not about to retire next year you desire development as well as concentrated investments for your Roth IRA. It is important to. Use this calculator to help you determine whether or not you are eligible to contribute to both the Traditional IRA and Roth IRA and the maximum amount that may be contributed.

2017 Roth IRA Phase Out Calculator. First you subtract 129000 from your income yielding 6000. 9 rows Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3.

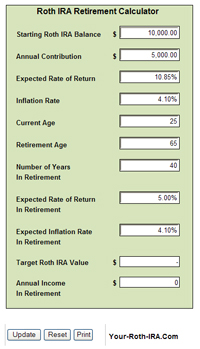

Enter your details into our IRA contribution calculator to see how much you are eligible to contribute annually. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. It is mainly intended for use by US.

Im additionally mosting likely to make a referral on exactly how to choose which of these 3 strategies is ideal for you. In this example the phaseout limit for your Roth IRA would be calculated this way. You can adjust that contribution.

It is important to. Roth IRA Phase Out Calculator. If you and your.

It is important to. The amount you will contribute to your Roth IRA each year. Roth IRA contribution limit calculator is devised to help you estimate the amount of contribution possible in your case for the tax year 2020 and 2019.

This calculator assumes that you make your contribution at the beginning of each year. If you are not covered by an employer-sponsored plan but your spouse is the deduction is phased out if the couples combined income is between 198000 and 208000. If your income exceeds the phase-out.

So how do you calculate a Roth IRA phase out contribution. If your income falls in a phase-out range you are allowed only a prorated Roth IRA contribution. Your ability to contribute to a Roth IRA phases out once your income exceeds the allowed threshold for your filing status.

In other words you wish. Eligible individuals age 50 or older within a particular tax year can make an. Annual IRA Contribution Limit.

January 31 2022 0 1 minute read The IRA deduction has an income threshold that you should know before thinking. This calculator assumes that you make your contribution at the beginning of each year. It works on a percentage basis.

Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Most earners qualify to invest up to the total annual contribution limit for Roth and traditional IRAs combined which is currently 6000 or 7000 for those ages 50.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. For 2020 the maximum annual IRA. At higher incomes your tax-deductible contribution to a regular IRA phases out.

Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022. So to calculate your reduced Roth IRA contribution limit you first calculate the percentage of the way you are through the 10000 phaseout range and then multiply that. Subtract the result in 4.

As with many points in life theres never. Divide that number by 15000. This is so because the law.

IRA Deduction Calculator 2022 Kyle Edison Last Updated.

Roth Ira Calculators

Roth Ira Calculator Roth Ira Contribution

Ira Calculator See What You Ll Have Saved Dqydj

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculators

Traditional Vs Roth Ira Calculator

Historical Roth Ira Contribution Limits Since The Beginning

Download Roth Ira Calculator Excel Template Exceldatapro

Compound Interest Calculator Roth Ira Online 52 Off Www Ingeniovirtual Com

What Is The Best Roth Ira Calculator District Capital Management

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator Calculate Tax Free Amount At Retirement

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Best Roth Ira Calculators

Traditional Vs Roth Ira Calculator